When it comes to renewing your car insurance or buying a second-hand vehicle, making a quick decision based solely on price or policy coverage is a huge risk. You might think checking MyCarInfo Insurance is enough to get the best deal, but if you skip one crucial step — checking the vehicle’s history — you could be paying for a car with a dark past.

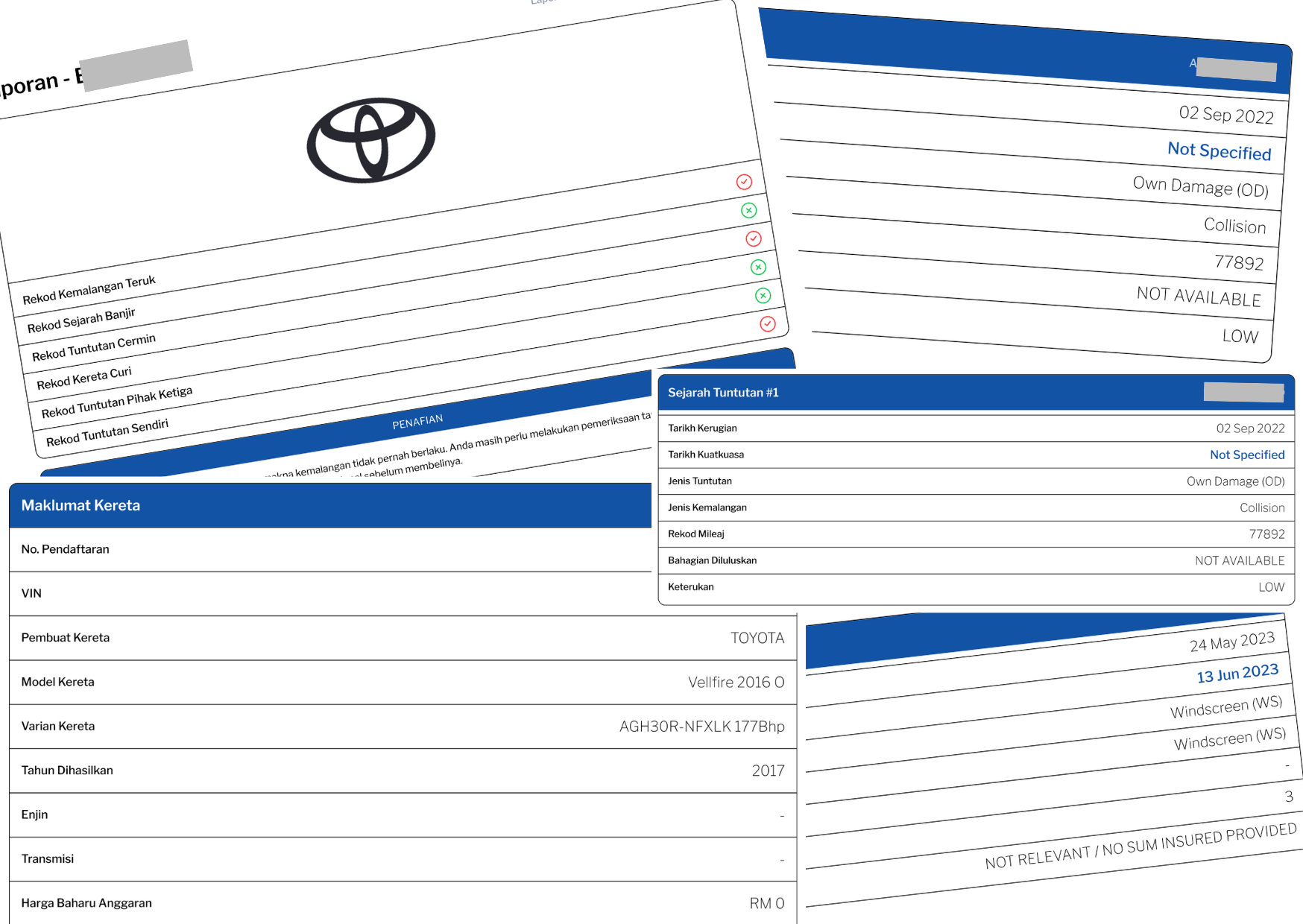

Before you proceed with MyCarInfo Insurance or any other insurance provider, it’s critical to first understand your car’s complete background. This is where Carpenia.com comes in — a trusted platform for checking used car reports using the chassis number (VIN) to uncover hidden issues like accident history, mileage fraud, and total loss records.

In this article, we’ll explore:

MyCarInfo Insurance is a digital platform that allows car owners and buyers to:

It’s a convenient tool, widely used in Malaysia by individual vehicle owners, car dealers, and insurance agents to get instant insurance estimates. MyCarInfo connects users with data from financial institutions and insurance companies, helping you make better-informed decisions.

However, MyCarInfo Insurance does not provide a full history of the car, such as:

These gaps can expose buyers and car owners to significant risks — and this is why Carpenia is a necessary companion tool.

When buying a used car or renewing your vehicle insurance, it’s easy to focus on just the insurance price or market value. But if you don’t know what the car has been through, you could be facing thousands in repairs — or worse, dealing with an insurance company that rejects your claim.

Here are real risks you may face without checking the car history:

Many used cars in the market look brand new — freshly painted, polished, and well-presented. But beneath the surface, some of these cars were involved in major accidents and underwent structural repairs. MyCarInfo won’t show this, but Carpenia will.

Some sellers tamper with the car’s mileage to make it look “low mileage” and justify a higher selling price. If the mileage is found to be inconsistent, your insurance company may invalidate your coverage in case of a claim.

Some vehicles have been declared as “total loss” by insurance companies due to serious damage. These are later auctioned off, repaired, and sold without disclosure. If you insure such a car unknowingly, its market value is significantly lower — and so is your payout in case of a claim.

Cars that have been repossessed, involved in flood damage, or have been through auctions often come with underlying issues. MyCarInfo doesn’t show this — but Carpenia does.

Carpenia.com is a powerful online platform that allows you to check a used car’s complete history by entering its VIN (Vehicle Identification Number) or chassis number. It provides a detailed report that includes:

With this data, you can make an informed decision before renewing insurance or buying a car — saving yourself thousands in potential losses.

✅ Fast and easy to use

✅ Accurate data from reliable sources

✅ Affordable pricing for a full vehicle history report

✅ Suitable for buyers, sellers, and insurance agents

Let’s say you find a used Perodua Myvi 2019 at a great price. You check MyCarInfo Insurance to get a quote and find a premium of RM850/year. You proceed to buy the car and renew the insurance.

Three months later, the engine begins having serious issues. A mechanic tells you the car was previously in a major accident and was declared a total loss. The frame was bent and poorly repaired.

You try to claim insurance, but it gets rejected due to prior damage history — something you never knew.

If you had used Carpenia, you would’ve seen the total loss history upfront and walked away.

Follow these steps to ensure your next vehicle purchase or insurance renewal is based on facts — not assumptions.

Ask the seller or check the car’s registration document to get the Vehicle Identification Number (VIN) or chassis number.

Go to www.carpenia.com, enter the VIN/chassis number, and pay a small fee to generate a full history report. This takes less than 5 minutes.

Look for red flags such as:

If everything looks clean, proceed to the next step.

Now, visit MyCarInfo to compare quotes and choose the best insurer. Because you’ve verified the car history with Carpenia, you can confidently renew insurance without surprises later.

1. Used Car Buyers

Buying from a direct owner or used car dealer? Always check with Carpenia first. Don’t rely on promises or appearance alone.

2. Car Owners Renewing Insurance

Even if you’ve owned your car for years, running a Carpenia report helps you validate its condition and insurance value.

3. Sellers Who Want Transparency

Use Carpenia to prove your car’s clean history. It helps justify your asking price and builds trust with buyers.

4. Insurance Agents

Help your clients by recommending Carpenia reports to avoid disputes and rejected claims in the future.

It’s important to understand that Carpenia and MyCarInfo Insurance serve different roles.

| Feature | Carpenia | MyCarInfo Insurance |

|---|---|---|

| Accident history | ✅ Yes | ❌ No |

| Mileage fraud check | ✅ Yes | ❌ No |

| Total loss status | ✅ Yes | ❌ No |

| Market value & insurance quotes | ❌ No | ✅ Yes |

| Insurance expiry & premium | ❌ No | ✅ Yes |

| Suitable for | Buyers & sellers | Vehicle owners |

For best results, use both tools together — Carpenia for the car’s background check, and MyCarInfo for insurance comparison and renewal.

People often hesitate to pay RM20-RM50 for a car report — but then end up paying RM5,000 to RM10,000 later in repairs or losing out on insurance claims. That’s the price of not knowing.

Here’s what skipping a Carpenia report can cost you:

Before you use MyCarInfo Insurance to renew or buy coverage, take a few minutes to check your car’s history on Carpenia. It’s fast, affordable, and could save you thousands.

A simple check can make all the difference between buying a reliable vehicle and stepping into a financial trap.

🔍 Check now at www.carpenia.com

Make informed decisions. Protect your investment. Drive with peace of mind.